What’s The Right Mix Of Salary And Incentive Pay?

- By: Tom McKeown

- Blog

- September 21, 2016

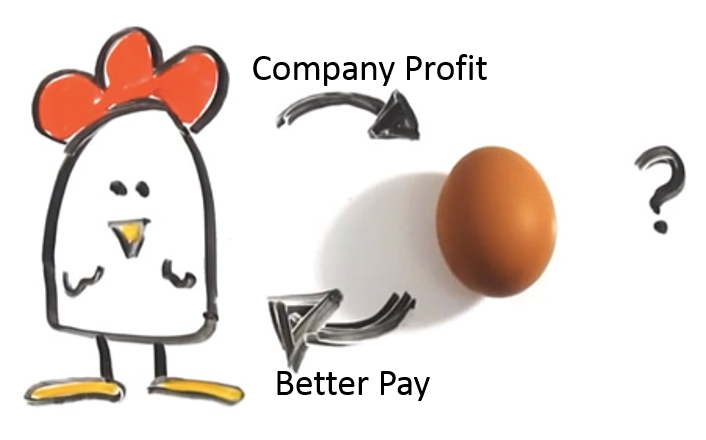

If you have ever run a company, then you know that balancing the dual objectives of growing profitably while keeping employee satisfaction up can be a challenge. It can often be a chicken and the egg thing. The company needs to make money to pay people, employees want to be paid well to perform, and the company needs high performing employees to make money. The dilemma is finding the right compensation philosophy for your organization.

The trend of increasing incentives versus salary picked up steam following the financial crisis of 2008 and 2009. According to Aon Hewitt’s annual survey on salaried employees’ compensation, the share of payroll budgets devoted to straight salary increases dropped to 2.9% in 2014, versus the 12.7% that was devoted to incentives/bonuses in that same year. But as the economy has started to pick up again, companies began feeling the pressure to elevate salary increases to keep their high performers in place. This pressure is also fueled by the prevalence of social media and salary market data available today, which let’s employees know exactly how much their peers are making for similar work at other places.

Robert Half did a survey in 2015 of 2,200 CFOs from across the United States, and 25 percent reported that they’d lost a key employee to a better paying job in the previous year. This has caused many companies to go out and purchase salary survey data to include in their annual compensation planning. Thus allowing them to pre-emptively bring the salaries of their high performing employees up to market levels. Noted Curo Compensation Consultant Ruth Thomas refers to this process as buying “Talent Insurance”.

There are best practices available for managing the compensation framework inside an organization, but as we know each company has its own uniquenesses. More established companies might have the resources to go out and purchase top talent with high salaries, while smaller growth companies might have to augment their compensation packages with higher incentives and equity to be competitive. That is why it is important to have a transparent and consistent compensation philosophy, so that you attract the right employees who are ready to embrace your organization for what it is.

Once you have established your philosophy, you can then begin to put the right processes in place. This is something you might be able to accomplish with in-house talent, but often it is necessary to find a consultant or vendor who has deep domain experience in compensation. If you are fortunate, you can find that expertise from a vendor that also provides a software solution that can automate your processes in an easy to use, centralized and secure fashion. This will put your company on the right track to address business growth and happy employees.

So, don’t let compensation planning get you down. With the right partner, processes, and software solution, you too can be on the Fortune list of best companies to work for.